I have next question for Megan ("Ask Megan" Campaign)

What factors can alter the current price of gold (raising or lowering it)? The overall "production" (mining) of gold is well known (what is an enigma is state of reserves), however there can be some unknown deposits as well as there can happen local unrests that will make gold mining impossible in some areas. Please explain, what are factors shaping the price of gold.

Furthermore, this price has limits. Now it's climbing a steep hill almost vertically, but also dangerously resembles a peak that occurred in 80s (that followed steep decline). What is your opinion about possible ceiling of current trend? Looking to your answer Megan......

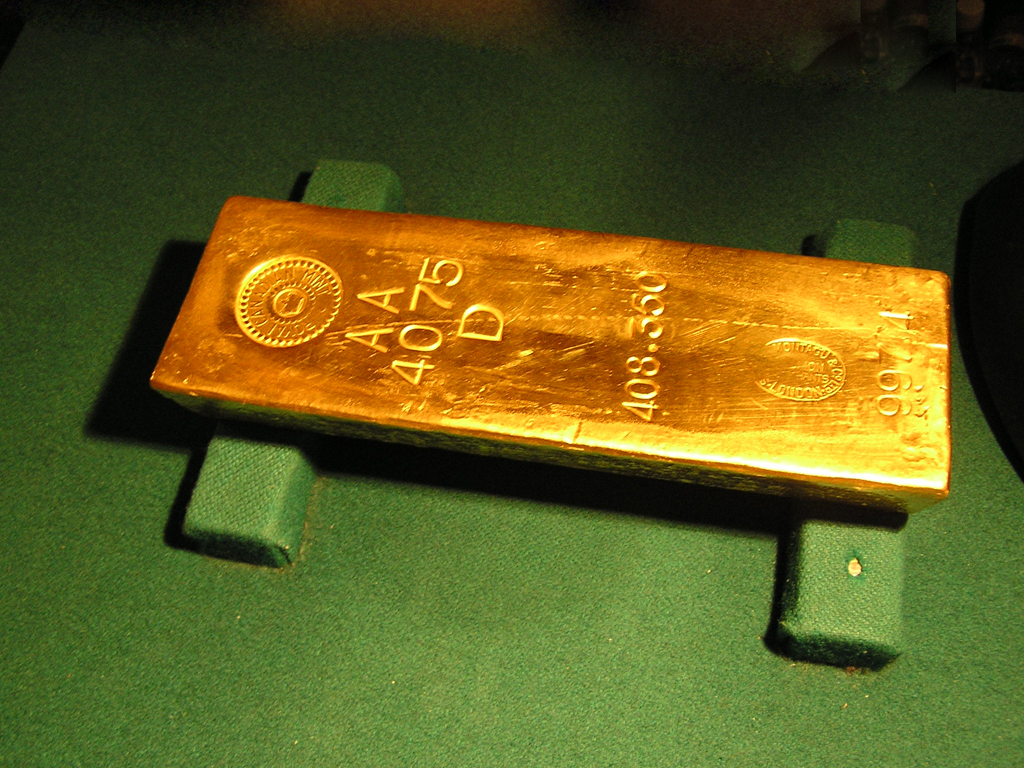

To kick things off we had our first question comes from Barbara in SWEDEN! Barbara asks, "Given the fact, that nobody really knows who controls the world's gold reserves (and who controls tungsten ingots instead) and who shapes gold supply and demand, is it a secure investment?" I think that's a great question! According to most documents you'll find around the internet, you'll see that the US is holding 70% of the world's gold in its reserves. I hesitate to say "allegedly" and go full conspiracy on you all - however if you can't see it or hold it, is it really there? The IMF reported that the US holds 8,133.5 tonnes of gold in their reserves with Germany, Italy, France and China next in line. Your skepticism of these numbers, Barbara, is healthy, in my opinion, due to the controversy and lack of evidence served to the people regarding the actual amount of gold in the reserves throughout history.

In fact, the story regarding Germany's move to bring their reserve gold local has many people speculating. Gold has always been a tool among nation-states to stabilize currencies, unfortunately every country was off the gold standard by the the 90's (Switzerland was the last to go in 1999). This doesn't mean, however, that gold reserves aren't kept as a storage of wealth for governments. In fact, that's exactly what the wealthy (-ier) countries do. In the news recently you have most likely seen stories about the Chinese government buying up gold...I find this, in the short game a fascinating thing to see. I wouldn't say ignore what the US government is doing with gold, but I wouldn't rely solely on their behavior to navigate your investment decisions. The US has lost/is losing their "World's Reserve Currency" status which means other countries are going to have a chance to build their economies, this time trying it "the right way" with an actual base to their currency as opposed to paper money printed on a whim. So aside from current events, gold is a historically sound choice for wealth preservation. For thousands of years it has been used as money and it holds some of the most coveted traits as a medium of exchange:

-It's easily divisible

-It's durable (gold does not rot and can store forever)

-It's beautiful

-It carries industrial use as well (conducts electricity efficiently thus is used in medical and electronic devices)

-It's scarce! (nobody likes runaway inflation!)

It's important when buying physical gold (or silver) to detach it from the USD price after purchase, unless of course you are in some short game with it. Having gold is having a piece of metal with intrinsic value that, according to most sources, is wildly undervalued in our current economy. Think about how it may serve you if the currency we know today (the USD) didn't exist. The idea of wealth preservation is nothing new, and Amagi Metals stands behind gold as an investment. Another great point to make is owning physical gold (not ETF's or futures) is the only way to truly store your wealth. You own it, you store it and have it in your hands in the event its needed and forever have a supply of wealth in a consolidated manner for your future generations or for your here-and-now. Hope this answered your question Barbara. We hope to hear from you or any of your Bitcoin Woman Magazine members soon!

Happy stacking,

Megan Duffield

If you have a question for me, send it on over to This email address is being protected from spambots. You need JavaScript enabled to view it.

!

Welcome to a new, weekly article (soon to be video) series called Ask Megan. As Marketing Manager, and regular contributor to our blog, I will be tackling questions from new investors. I've been immersed in the precious metals world for the past 4 years - first with my previous work for the film Silver Circle and now with Amagi Metals. I've interviewed big names in the PM world like David Morgan, Jeff Berwick and spent a lot of time at Mises and Cato financial events learning from some of the best in the sound money world. The goal is to help new investors become more clear on why and how to invest in precious metals...and I'd be happy to talk about cryptocurrencies as well (I'd consider myself an early adopter of sorts)! You can send in questions to This email address is being protected from spambots. You need JavaScript enabled to view it.

. We'll do our best to answer all the questions we receive, in hopes to educate more and more people on the importance of financial responsibility and preserving your wealth.

Megan Duffield

(Ask Megan is not to be confused with investment advice and is not responsible for individual's investment decisions...it's just a great place to learn!)

...Very good answer to my question, but still have no idea where the gold reserves are :)

Barbara Messer